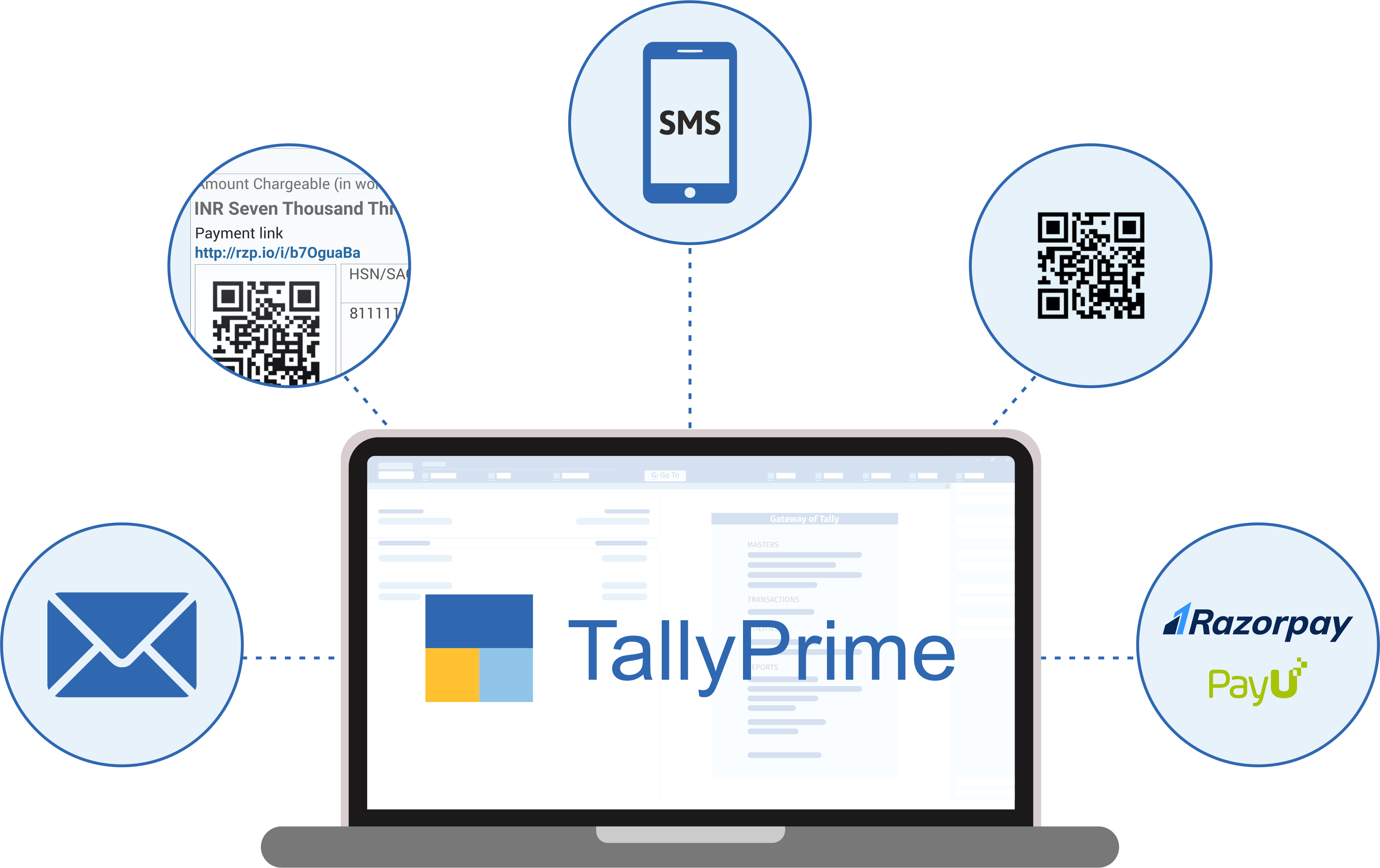

In today’s fast-paced business environment, managing cash flow efficiently is crucial for sustained growth. One of the biggest challenges businesses face is the timely collection of payments from customers. To simplify this process, TallyPrime offers seamless integration with payment gateways, ensuring a hassle-free and swift payment collection experience. This feature not only enhances operational efficiency but also improves the customer experience by providing multiple payment options.

The necessity for payment gateway integration

Historically, companies used to make use of manual payment collection processes, which were slow and error-prone. Delayed payments could adversely affect cash flow and business operations. To address these issues, payment gateway integration with TallyPrime helps to ensure:

Accelerated payments with automated processing.

Error reduction while reconciling.

Increased customer ease with various payment options.

Real-time monitoring of transactions.

How TallyPrime Payment Gateway Integration Functionality Works

- Direct Generation of Payment Links from TallyPrime

TallyPrime enables companies to create payment links from invoices. This reduces the requirement of sharing bank information manually and lowers the reliance on conventional payment collection processes.

- Multi-Payment Support

TallyPrime accommodates several digital payment modes, such as:

Credit/Debit Cards

Net Banking

UPI

Digital Wallets

This provides greater customer convenience and improves the chances of prompt payments.

- Automated Payment Reconciliation

One of the biggest time-consuming jobs for companies is reconciling payments with bills. TallyPrime does this process automatically by:

Matching received payments with respective invoices

Real-time updation of payment status

Creating reports to provide improved financial insights

All this saves businesses from manual discrepancies and provides authentic financial records.

- Real-Time Payment Monitoring

Through integration of TallyPrime’s payment gateway, businesses can monitor payments in real time. This service assists in payment tracking, issuance of reminders, and ensuring transparency in finances.

Advantages of TallyPrime’s Payment Gateway Integration

- Enhanced Cash Flow Management

Through the ability to collect payments quickly, companies can have a consistent cash flow, with less reliance on credit.

- Better Security and Compliance

TallyPrime keeps all transactions safe, lowering the risk of fraud. It meets industry standards, so businesses can trust it.

- Saves Time and Decreases Manual Work

Automating payment reconciliation and collection saves precious time, enabling companies to channel their energy toward growth initiatives instead of paperwork.

- Improved Customer Experience

Providing multiple payment choices simplifies payments for customers, enhances their experience, and builds long-term business relationships.

Conclusion

TallyPrime’s intuitive integration with payment gateways is a business changer for companies interested in streamlining the payment receiving process. TallyPrime facilitates the automation of payments, minimizing errors, and enhancing cash flows, thus allowing companies to conduct their business efficiently. If you wish to revamp your finances, it is time to use the power of TallyPrime and its linked payment solutions