Defi Unlocked: Empowering Credit Flow for Growing Business

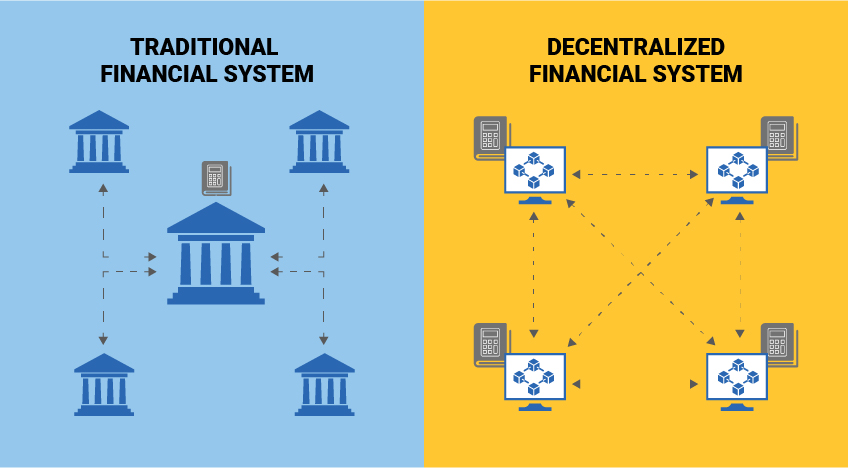

Decentralized Finance or Defi unlocks the financial domain by making credits accessible to a business in effortless ways. Where traditional financing presents rigid requirements along with lengthy periods of approval processing, Defi utilizes blockchain-based technology to streamline faster and highly accessible funding

How is Defi transforming Business Credit

Defi platforms are remodeling the way in which businesses look for loans, and how business credit is processed. Some important benefits include:

- No Intermediaries: Borrow directly from decentralized lending pools, no banks involved.

- Faster Approvals: Instant loan disbursal through automated smart contracts.

- Low Interest Rates: Competitive rates since overhead costs are lower.

- Access Worldwide: Any business can acquire funding without geographically bound conditions.

- Defi Credit Solutions for Businesses

A few Defi protocols are more business-friendly for financing:

Decentralized Lending Platforms: Aave, MakerDAO provide business loans against digital assets.

Stablecoin Loans: Businesses can use stablecoins to hedge against crypto volatility.

Smart Contract-Based Credit Management: Automate repayment schedules and reduce default risks.

- Challenges and Considerations in Defi Credit

- DeFi credit has its advantages, but it also has challenges such as:

- Regulatory Uncertainty: Governments are still forming Defi regulations.

- Collateral Requirements: Most Defi loans require crypto collateral.

- Security Risks: Smart contract vulnerabilities can pose risks to borrowers.

Conclusion

Defi unlocks new opportunities for growing businesses, making credit more accessible, efficient, and transparent. As the ecosystem matures, businesses can fuel their growth through Defi solutions while navigating the associated risks. Decentralized finance adoption helps companies break free from traditional banking constraints and tap into a borderless financial system.